Rules should be created and enforced reasonably, fairly, and consistently.

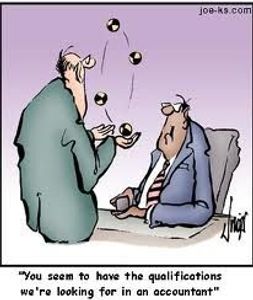

"Any form of concealment begs suspicion."

Withholding Financial Information from Homeowners

Non-board-member homeowners should ask tough questions. They are entitled to request records and to lobby for a financial audit.

Transparency should always be of utmost priority for board members, especially in areas related to finance. Any form of concealment begs suspicion.

Any board member, officer, or management company that conceals records and financial transactions should be suspect. Best practice would mandate association finances to be transparent to the homeowners at all times.

The monies belong to the homeowners as a whole.

Be vigilant about your HOA’s accounting practices. Be informed and demand transparency.

HOA's DO NOT PAY PROPERTY TAX ON COMMON PROPERTY IN PA!

But our HOA did... The previous board paid some of the tax occasionally, sometimes they did not. Why didn't anyone on the previous Board have the business sense to realize the HOA did not pay tax on the real estate within a planned community that is owned by the association?

Delay in oversight of management co. accounting processes

UPDATE: 5/6/2019, Finance Committee has adopted another of our ideas regarding bank reconciliations (well, better late than never).

"Finance Committee Notes 4/26/2019: "Committee member obtaining copies of recent HOA bank reconciliations from CCM to review and verify and will review them quarterly in the future." (See note above dated 5/6/2019).

Yep, for the last two and half years the Board has allowed the management company to reconcile our bank statements (not a good practice).

Over a year (2017-2018) of HOA financial statements and accounting procedures were not being thoroughly reviewed, the Finance, Budget & Insurance Committee ("Committee") had no access to the HOA's online bank account, and they were not reconciling our monthly bank statements.

- The Committee waited until April, 2018 to start reconciling the HOA's bank statements?

- The Committee didn't ask for access to the HOA online banking until April, 2018?

- The Committee didn't discuss the management company's accounting and reporting procedures until January, 2018?

- The Committee didn't know what accounting process the management company was using until December, 2017?

Source: April 18, 2018 - Finance, Budget & Insurance Committee Notes

- "Pursue getting access to the HOA online bank account in order to facilitate downloading month end bank statements."

- "Reconcile the bank statement monthly."

- "Do a quarterly internal review of the HOA financials."

Source: January 2, 2018 - Finance, Budget & Insurance Committee Notes

- "A follow up meeting with [the management company] will be scheduled to discuss their accounting procedures and reporting format."

- "A potential change was discussed to improve the ability to report the operating fund results separately from reserve fund activity."

Source: December 12, 2018 - Finance, Budget & Insurance Committee Notes

- "Met with [management company] to discuss their accounting policies."

Source: December 7, 2017 - Finance, Budget & Insurance Committee Notes

- "Set the next meeting for December 12th. [Management company] will explain the current accounting method..."

- "Decided to meet in the near future with [management company] to hear what the current accounting method is and what method might best serve us going forward."'

Would a $94,170 financial mistake concern you?

"It's just a simple accounting error." *

?????????????

"...accounting was done in reverse." "Everyone makes mistakes." *

(Source: audit correspondence and the HOA Board's "Guest Speaker", September 20, 2018 Board Meeting)

*We're not kidding, this was actually said by an accountant regarding a $94,170 error.

We submitted a proposal to form a Contract Review and Negotiating Committee in June, 2018.

We presented a proposal to the HOA Board of Directors on June 1, 2018. We have had no acknowledgement or response from the Board. The Board promised to "get back to us." We have been waiting for a response.

UPDATE 12/2018: The December, 2018 Finance, Budget & Insurance Committee Meeting Notes indicate that a "possible 2019 project" could be the "review of all contracts and whether to establish a contract review sub-committee ."

WHY ARE WE DELAYING SOMETHING SO IMPORTANT? WHY IS THE FINANCE COMMITTEE MISAPPROPRIATING OUR PROPOSAL?

WE NEED NEGOTIATING AND CONTRACT REVIEW HELP NOW! The Contract Review and Negotiating Committee needs to be led by competent, experienced and skilled negotiators whose only focus is successful negotiating, review and execution of contracts. This Committee will also monitor and enforce vendor contract compliance.

Here are some issues we found in our financial documents review.

The wrong people had access to the HOA's bank accounts and Certificates of Deposit (2017-2018)

The wrong people had access to the HOA's bank accounts and Certificates of Deposit (2017-2018)

The wrong people had access to the HOA's bank accounts and Certificates of Deposit (2017-2018)

All of 2017 until we made this discovery in August, 2018, the signatories for the HOA's bank accounts and over $50,000 in CD's at a local bank were the management company owner and her son.

(Source: HOA bank account statements)

Checks in excess of $10,000 routinely had only one signature (the Management Co. owner).

The wrong people had access to the HOA's bank accounts and Certificates of Deposit (2017-2018)

The wrong people had access to the HOA's bank accounts and Certificates of Deposit (2017-2018)

There are no limits on the HOA check amounts that can be signed by the owner of the management company. (Source: management company owner and check copies.)

Contracts did not have correct authorization and signatures.

The wrong people had access to the HOA's bank accounts and Certificates of Deposit (2017-2018)

Outdated and inefficient document storage, retention, and maintenance. Lack of technical knowledge.

Community documents require that contracts over a certain amount must have 2 signatures. Some contracts from 2017 had only 1 signature, leading to questions of the contract's validity.

Outdated and inefficient document storage, retention, and maintenance. Lack of technical knowledge.

Outdated and inefficient document storage, retention, and maintenance. Lack of technical knowledge.

Outdated and inefficient document storage, retention, and maintenance. Lack of technical knowledge.

The management company uses online payment services for only one account. All other expenses are paid by paper checks, signed by the management company owner.

Both the Board and management company maintain too many hard copies of documents and storage practices are less than secure. Developing an electronic storage and document management plan is recommended.

There appears to be a lack of proficiency in QuickBooks software usage.

(Source: management company owner, check register, observation at Clubhouse)

2017-2018: Seven (7) months of balance sheet errors found.

Outdated and inefficient document storage, retention, and maintenance. Lack of technical knowledge.

"Kickbacks" to the management company from Costco and Sam's Club and a personal credit card.

The balance sheet errors were reported to the Finance Committee and management company late last year (2017) and the Treasurer received documentation of the errors on June 1, 2018.

As of September 21, 2018, no corrections have been made.

"Kickbacks" to the management company from Costco and Sam's Club and a personal credit card.

Outdated and inefficient document storage, retention, and maintenance. Lack of technical knowledge.

"Kickbacks" to the management company from Costco and Sam's Club and a personal credit card.

The HOA does not have its own membership cards to the membership-only warehouse clubs or an Association credit card.

Most of Sewickley Ridge HOA's supplies are purchased from the warehouse clubs. Our money is used for the purchases and the management company receives the money from the yearly reward programs for the purchases. Since it's the HOA's money doing the buying; shouldn't the HOA receive the monetary "perks"?

Also, the management company owner uses her personal credit card to purchase items for the HOA and then bills us for the amounts. Again, it is our money making the purchases and the management company receiving the credit card rewards.

(Source: management company owner)

$51,000+ cost to the HOA in legal fees*

SUMMARY OF MAJOR ISSUE:**

The HOA brings legal action against residents because their patio exceeded size requirements set forth in ARC Committee Rules.

- The Rules were not published until eighteen (18) months after the patio construction was completed.

At the time the patio was built (2014) there was no Architectural Review Committee.

- TOA allowed work to proceed without a variance.

- Yet, in 2017, the new, resident-controlled HOA Board initiates a legal dispute against the residents with a two-year old patio for not obtaining a variance in 2014 from a committee that did not exist yet.

BACKGROUND:**

January 2016: the Board (still TOA-controlled) initiated the formation of an Architectural Review Committee (ARC).

- Minutes from the Board meeting in January 2016 document that there was a review of violations as part of an Architectural Review Update: the review revealed that there were no current outstanding violations.

- TWO YEARS after the patio was constructed: the residents from a neighboring unit file a formal complaint regarding the size of the patio. [These are the same residents for whom TOA built a retaining wall beneath the patio in 2014.]

At least 11 other patios in the community exceed the 16-foot limitation.***

- Some have variances; some do not.

- Construction began on some additions without a variance only to be approved later.

- Some residents received approval from the Board to construct patios that exceed the limitations documented in the Rules & Regulations.

Other residents whose additions were part of their contracts with TOA did not need ARC/Board approval and were permitted to install larger patios and other improvements that were not in compliance with the community’s governing documents.

*Source: Monthly Financial Statements

Board Meeting, October 10, 2019

**Source: Arbitration Documents

***Source: ARC Meeting Minutes, 2017-2019

ARC Variances/Requests for Modification, 2017-2019

3/17/2019 - December 2018 Financial Statements Posted

It's MARCH 17, 2019: The December 2018 monthly financial statements are finally available!!

Do not be misled by the latest "Financial Statements Review for the year ended December 31, 2018."

They do not reveal the detailed expenses for December, 2018.

The first 4 months of 2018 financial statements are still missing from the HOA website.

But hey, you don't care where your money is going. Right?

Landscaping $$$: More Excuses and Poor Planning

ARE YOUR MONTHLY ASSESSMENT DOLLARS BEING SPENT WISELY? Are we getting the services we pay for?

2 years with no proper aeration of lawns; yet we paid $151,012.26 for nine months of landscaping.

Plus an additional $10,000 in the budget for "Landscape-Other."

As of September 2018, $6,623.05 has been expensed for "Landscape-Other."

But we can't afford to aerate?

HOA Financials and Spending

2022 Budget

- 15% increase in monthly dues/assessment for 2022.

- 71% increase in snow plowing expense; less service, yet we're paying much more:

- We continue to pay for a set number of occurrences, regardless of snow amounts/events.

- Service trigger for snow plowing increased.

- Time for completion of plowing extended.

- 14% increase in landscaping contract.

- 3 year HOA contractual commitments OVER $1,000,000 (that's right, ONE MILLION DOLLARS) with one vendor for both landscaping and snow plowing. So, we commit over a million dollars in homeowner money to a single vendor and homeowners still lose services ???

Welcome to a website committed to Sewickley Ridge homeowners

An independent website providing a communication alternative to a Board-controlled, restrictive HOA website and Message Board. Homeowner comments and questions are encouraged.

Cookie Policy

This website uses cookies. By continuing to use this site, you accept our use of cookies.